Regardless of which side you were on for the 2024 US presidential election, everyone felt a common reaction— shock.

Democrats were shocked that Donald Trump won all 7 swing states, Republicans were shocked that they won the popular vote, and the hundreds of pollsters who called the election to be within 1-2 points were certainly shocked above them all.

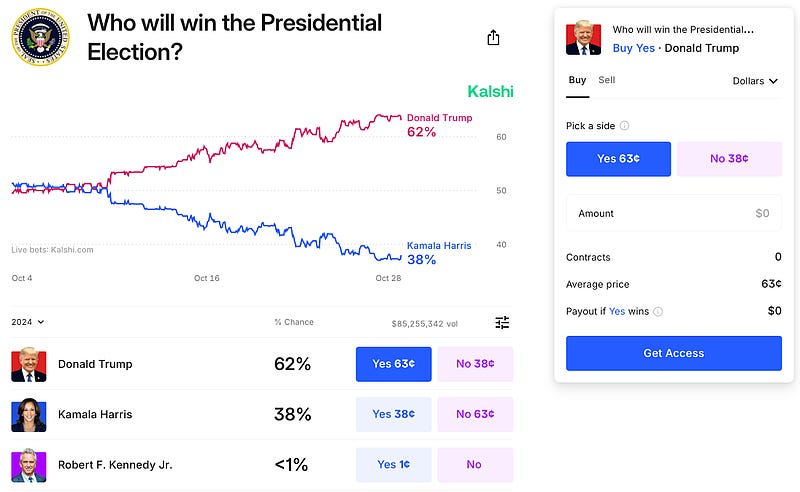

Perhaps the only ones not so shocked were the betting platforms, which priced in a ~60% probability for a Trump victory.

Polls, experts, and political commentators stubbed their noses at this figure, calling it the collective ignorance of the right and continued to project “one of the closest elections in the decade.”

They were wrong, and the market was right.

Out of all of the prediction markets, Kalshi emerged as the clear winner.

As the only regulated player in the US and recently granted approval to offer election betting, Kalshi received 1m new user sign-ups, over $1bn trading volume during election night, and became the most downloaded app on the App Store.

So, what is the story behind Kalshi’s apparently overnight success? Why are people suddenly interested in betting on events? What might the future look like for Kalshi and companies like it?

Keep reading to find out!

What is Kalshi?

To understand what kind of company Kalshi is, we first need to visit the company’s fascinating founding story.

In 2018, Kalshi was founded by a couple of traders at Citadel (one of the most successful hedge funds in history), Tarek Mansour and Luana Lopez Lara.

The pair met during undergraduate at MIT, and both shared a deep interest in the world of finance. Luana had worked as an SWE at the macro-driven hedge fund Bridgewater and as a quantitative trader at Five Rings Capital and Citadel Securities.

Tarek shares an equally impressive resume. Beyond absolutely crushing it at MIT (Tarek boasts a 5.0/5.0 GPA on his LinkedIn, lol), he worked as a quantitative trader at Goldman Sachs and a Global Macro Trader at Citadel.

It was at Goldman where the first seedling of Kalshi appeared in Tarek’s mind. Before major events (e.g, Brexit), clients want to bet for or hedge against certain outcomes. Goldman, in turn, would construct complicated financial bundles (e.g., options, futures, swaps) to approximate the risk curve of the actual event.

However, approximations are, ultimately, just approximations.

“What you couldn’t do was just trade directly on the event itself, even though that would have been simpler and cheaper and was what people wanted. The option just didn’t exist.” — Tarek

After meeting with Luana, who had similar experiences and frustrations trading for Citadel, the pair decided that this was a big enough problem and quit their insanely high-paying jobs to start Kalshi.

Kalshi was not off to a hot start. In fact, it was barely off to a start.

Unlike typical startups that hire a team of SWEs to aggressively ship their products to customers, Kalshi hired a team of lawyers and shipped legal documents to the US courts and regulators.

This process took nearly 3 years.

Finally, in 2020, Kalshi officially became the first fully regulated financial exchange in the US specifically for event contracts, officially designated as a Designated Contract Market [DCM] by the Commodity Futures Trading Commission [CFTC].

In 2024, it achieved another major legal milestone. The US Courts of Appeal upheld a previous decision that defended Kalshi’s ability to offer legal election betting. This was monumental for the Kalshi team and the events betting world, as election betting finally became legalized after a century.

(FYI- this whole case is fascinating. For anyone interested, you can find the most recent decision from the Appeal’s Court here, and some analysis of the previous case here)

So, what is Kalshi today?

Kalshi is the first fully regulated prediction market that allows US users to trade on the outcome of future events.

The likelihood of future events occurring was acknowledged as a new asset class known as events contracts. Kalshi users can purchase “yes” or “no” positions on whether or not these events will occur, at varying probability levels.

Kalshi’s betting categories include politics, economics, pop culture, weather, etc. Users can bet on hundreds of event contracts ranging from topics like whether or not the FED will cut or hike interest rates to comical topics like whether or not Mufasa’s Rotten Tomato score will be above 65 (FYI- I am betting my house on Yes).

Kalshi’s growth has been explosive. Since Q1 2024, Kalshi’s active user count grew by 5x, increased trading volume by 50%, and doubled the # of markets listed to 300+. While there is no publicly available revenue figure, we know it takes roughly 0.08% per trade.

Finally, Kalshi is backed by a team of brilliant VCs and individuals. In 2021, it raised a $30M Series A led by Sequoia and joined by leaders in the financial industry like Charles Schwab and Henry Kravis. During the election boom, Kalshi had no problem securing additional capital, and very easily. See the now-deleted tweet by Tarek.

Like Ali Partovi said, the next phase of Kalshi will certainly be “go go go.”

Prediction Markets: Love it or Hate it?

People often shift in their seats when hearing about betting on particular events.

For its part, Kalshi has also received backlash for some of its bets, like whether or not the missing Titanic submarine will resurface.

People’s concerns typically come from 2 fronts.

The first is legal. Organizations like Better Markets and the CFTC have argued that betting on elections constitutes “gaming” and thus violates the law. The second objection is moral. There is just something that feels wrong about betting on elections or whether or not a hurricane is going to hit.

Legally, I’ll defer my opinions to the judges. To understand why Kalshi’s election betting is not “gaming,” nor “contrary to the public interest,” read the court rulings here and here.

Now, the moral objection. An op-ed nicely sums up the argument:

“Allowing gambling for elections diminishes the sanctity of the democratic process and reduces it to mere profit opportunities, which creates incentives for manipulation and erodes public trust.”

Ah, of course. Before Kalshi, the US election certainly was the poster child for sanctity: one without widespread claims of voter fraud, foreign and domestic influences, and denial of election results by a Presidential candidate.

Look how far the US election’s sanctity has fallen… all Kalshi’s fault.

Sarcasm aside, there have always been profit opportunities in elections, or for that matter, any major events. Like the Goldman trading bundles or retail betting heavily into crypto before a Trump victory, humans have always found a way to profit.

Instead, I would argue that events betting actually creates economic value as an instrument for risk transfer and improves the status quo through market wisdom.

If you look at the history of commodity futures or financial derivatives like interest rate swaps, the commonality that underpins all these financial derivatives is the idea of risk transfer.

Eloquently explained by Tarek on the Prof G Podcast, events contracts also create a marketplace where the underlying risk of events is transferred from those who do not want to bear the risk to those who are capable of bearing it.

For example, risk avoiders like homeowners in Key West, Florida (where insurance companies pulled out from housing insurance) can bet on “hurricane hitting Key West” to offset potential financial losses. Risk takers like traders can bet on the other side to take over that risk and receive potential financial rewards.

Lastly, prediction markets are often better at understanding probability than apparent “experts.” When you have a large enough group of knowledgeable individuals driven by financial incentives, an efficient market occurs.

Kalshi is made up of tens of thousands of traders, speculators and sophisticated experts. Once the probability of an event gets out of whack (e.g., 70% Trump victory), profit opportunities emerge, and traders will take positions to bring the prices back to an acceptable equilibrium.

I am not claiming that Kalshi’s markets are 100% efficient, but I do believe that market wisdom often trumps individual experts. On Kalshi, more accurate predictions are often made on things like the FED’s interest rate decisions, the TikTok ban, the Boeing CEO, and even the weather.

Although there have been little estimates on how large the events betting market could become, it should be evident that it is here to stay, and for good reasons.

Like it or not, get on board.

What I like about Kalshi

1. Riding the retail trading tailwind

In the US, retail trading is now 25% of total equities trading volume (up from 10% in 2019) and 35% of total options volume. Crypto has shifted mainstream, with over 300m people worldwide owning cryptocurrencies. Sports betting is now projected to be one of the fastest-growing industries in the US at 10.5% CAGR. The list continues.

This begs the question, why is this happening, and how can this benefit Kalshi?

Technology and friendlier regulations are enabling new financial products to be created and marketed toward retail investors. The new Trump administration has been vocal about support in capital markets of all forms. Kalshi wins.

The wild west of finance is attractive to retail investors, see r/wallstreetbets and crypto in general. Logically, there is more opportunity for retail profit in markets less controlled by sophisticated institutions. Kalshi is one of those markets.

Retail likes to be experts in topics they believe they understand (e.g., sports betting, technical analysis). Kalshi is perfect for “experts,” real or not, to test their expertise and put their money where their mouth is.

Democratization of financial opportunities has become a big theme in both retail trading and VC investments. With Kalshi allowing users to create their own bets, this represents the epitome of democratized finance.

2. Increasingly likelihood of institutional adoption

As markets become more mature, institutions move in and drive up the trading volumes, liquidity, and legitimacy of the new markets. For reference, just take a look at how the crypto market did after Blackrock launched their Bitcoin ETF.

Currently, we are seeing the early stages of institutional adoption at Kalshi. Susquehanna, one of the largest options and ETF market makers, was onboarded as an institutional market maker recently, providing close to 30x the liquidity in some previous markets.

Typically, once one shop is onboarded, others will race to join as well to capture new opportunities. As a result, Kalshi's liquidity and functionalities should improve massively in the coming months.

3. A simplified way to trade stocks

When NVDA 0.00%↑ dropped after beating earnings in Q4’24, traders were confused.

Traders often miss because stock prices factor in a myriad of events, many outside of their anticipation (e.g., Covid-19, Elon sending a rogue Tweet).

However, if you can simplify the bet that you are making from “if TSLA 0.00%↑ is going to go up” to a yes or no bet on “whether or not they will sell more than 735,000 cars”, why wouldn’t you eliminate those other systematic risks?

For both institutional or retail traders with a specific thesis in mind (e.g., Nike on-shoring, battery prices rising), this may represent a better way to trade stocks without taking on wider market risks.

If traders buy into this, perhaps Kalshi can take some share from traditional equities.

4. Regulatory approval as a real moat

Regulations matter, especially in a market like financial services.

Kalshi knew this. Inspired by Coinbase and its regulatory approach, Kalshi’s mission from day 1 was to obtain regulatory approval and become a DCM.

This has proved to serve as a real moat. In the same industry, competitors have faced a ton of scrutiny, like Polymarket CEO Shayne Coplan being raided or PredictIt being banned in the US.

In comparison, Kalshi has a good relationship with regulators due to their continuous engagement. Hence, it is often privy to real-time information and has open communication channels. Additionally, Kalshi has an amazing backend infrastructure set up, as required by the regulators. Its system is equipped to handle institutional-level trading activities and has the highest security standards in the industry.

What my concerns are

1. Markets get exploited, especially new markets

When profits exist, people exploit them.

No market is 100% efficient, and certainly not emerging markets like this one. Insider trading, arbitrage, and general market inefficiency will be present. For example, those privy to satellite data could scrape them to better predict the weather. HFTs may take advantage of probability spreads across different markets to perform arbitrage.

Too much market inefficiency not only scares away traders but also invites strict regulations. It is hard to predict how efficient prediction markets will become (no pun intended), but if Kalshi becomes a market riddled with inefficiencies and potential financial crimes, then it will be shut down by regulators.

2. Regulatory challenges will continue domestically and internationally

Despite its good relationships with regulators, some regulatory challenges have impacted Kalshi, such as the CTFC’s lawsuit to shut down election betting. More legal challenges may emerge as Kalshi grows and enters into new horizontal markets.

Also, given how different regulations are across international markets, expansion may prove to be cumbersome. There is no current roadmap for new geographies, but future expansion may be slow due to complexities in new geographies.

3. Increase in competition after recent success

Similar competitors have filed for DCM status in the US, according to disclosures by the DC Circuit. With Kalshi as a precedent, it is likely that their status will be approved, and Kalshi will face additional competition.

Additionally, existing players like Polymarkets could also seek legal status in the US. Compared to Kalshi, Polymarkets has more prediction markets, although many exist because they are not confined by legal regulations.

Given the nascency of this market, customers likely have little loyalty to particular platforms. This means that if competitors can offer better products, they will churn.

Food for thought

There are a few initiatives I think Kalshi can make to drive user engagement and grow as a platform.

1. Empower user-generated bets to differentiate against competitors

While Kalshi has a large internal contracts team, including international debate champions, to come up with new bets, the gold mine is really the user-generated bets.

This is the epitome of democratizing finance. Kalshi offers users the ability to come up with their own bets, which feeds into retail trader’s desire to be “experts”.

Kalshi can encourage more user-generated bets in a few ways:

Financial incentives by giving users a small % of all trading fees generated on their bets. This could literally create new careers for people as professional events contract makers.

Gamify the experience by having a user-generated bets leaderboard. Rank the bets based on real-time trading volume.

Massively market this across social media platforms. Create giveaways for the most unique bets or category winners. This will capture significant attention from potential new users.

If Kalshi embraces user-generated bets, a whole host of bet makers can be onboarded and existing users will be way more likely to engage with the platform repeatedly.

2. Partner with institutions to drive trading volume

Give major banks like Goldman Sachs and Morgan Stanley significant benefits to funnel their client’s bets to Kalshi.

Like Tarek mentioned, many of the asset managers’ clients often want to invest based on major events. Instead of having to create complicated financial packages themselves, banks can partner with Kalshi to funnel their clients’ bets to the platform, and Kalshi must offer dedicated institutional client services.

If Kalshi can partner with these major institutions, more market makers and liquidity providers will be incentivized to onboard, creating a virtuous cycle.

3. Introduce leverage to drive more volume

Both institutional and retail investors appreciate the ability to trade larger positions with smaller amounts of capital. We have seen very successful examples of volume increase after leverage is introduced (e.g., Robinhood).

Currently, Kalshi does not offer any leverage for its trading activities due to regulatory concerns. However, proper structure in place, like pre-funding requirements and setting leverage ratio, can prevent excessive risk-taking and safely attract more capital.

Final thoughts and recommendation

I like to evaluate companies on 4 key criteria: runway for growth, ability to execute, product-market fit, and defensibility.

Runway for growth: 4/5. The events contract market is still very nascent. The industry will still continue to mature, following the trend of financial derivatives creation and the democratization of finance. Kalshi, in particular, still has much room for horizontal expansion into different event categories.

Ability to execute: 5/5. The Kalshi team is highly experienced and has successfully obtained legal and regulatory approval. They have shown an impressive ability to work with regulators and market their products to consumers through the US election.

Product-Market Fit: 3/5. Especially after the US election, Kalshi has found a group of zealous early adopters. However, whether their user base will expand to include the broader retail investors and institutions remains a question mark.

Defensibility: 4/5. As the first fully regulated DCM in the US, Kalshi has had a headstart in a massive market. While this is a considerable moat and first-mover advantage is real in markets like this, new competitors are emerging.

Overall score: 9/10 (Invest with confidence).

Honestly, this combination of founder, market, and product is a rare find.

The founding team is clearly brilliant, comes from massively impressive backgrounds, and has shown they can do the hard but necessary things first.

I see the events contract market as the next big financial derivatives. Institution dollars are beginning to flow with major players rushing to become market makers. New competitors are also emerging to compete in this high-potential market.

Customers have embraced the product, as demonstrated during the 2024 US election. Kalshi was able to leverage its status as the first regulated exchange to capture the market leader position and branded itself as the most trusted platform.

After recent events, a massive upround by Kalshi is almost all but certain.

I truly believe that an investment in Kalshi right now is one of the best bets in the financial services industry.

As long as Kalshi can keep working effectively with regulators to ensure the integrity of its products and expand into new verticals to stay competitive, investing now is like getting into Robinhood or Coinbase in 2015.

To put my money where my mouth is, I will happily set up a Kalshi bet that the company raises an upround by 2025.

Only I am not sure if anyone is willing to take the other side of this trade ;)